Morningstar DBRS Comments on MISO’s Historic $22 Billion Regional Transmission Plan

Key Highlights

• We expect the credit impact of Tranche 2.1 on utility companies to be neutral, provided that they can finance the capex and maintain their debt-to-capital ratios in alignment with the regulatory capital structure.

• MISO’s alignment with FERC Order No. 1920 should benefit transmission owners.

• Legal challenges to right of first refusal laws could create delays.

• Uncertainty on decarbonization policies could weaken cost-benefits

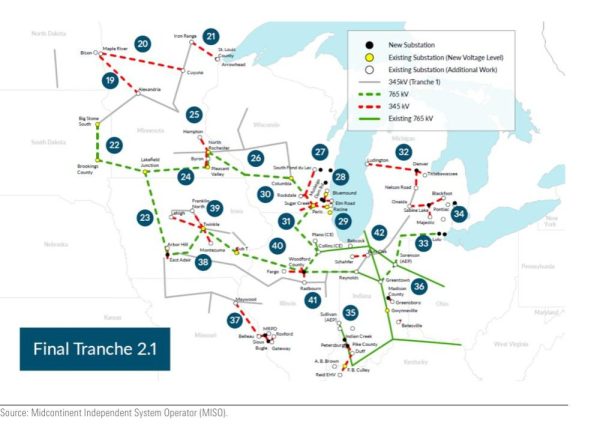

On December 12, 2024, the Midcontinent Independent System Operator’s (MISO) board (encompassing 15 member states in the Midwest and the South) approved a $21.8 billion grid expansion plan, Tranche 2.1, the largest regional transmission upgrade in U.S. history. MISO’s Tranche 2.1 is part of MISO’s Long Range Transmission Planning (LRTP), which will help ensure long-term grid reliability and efficiency. Additional tranches are anticipated to address broader transmission needs, with the overall investment in MISO’s LRTP potentially reaching $100 billion.

Tranche 2.1 highlights growth opportunities for the affected utilities, but the trend of elevated capital expenditures (capex) is likely to persist in the long term, which may result in a temporary weakening of credit metrics. Nonetheless, we consider the overall impact to be neutral, bolstered by the Federal Energy Regulatory Commission’s (FERC) credit-supportive regulatory framework.

Key Highlights of Tranche 2.1

• Portfolio Overview: The Tranche 2.1 portfolio consists of 24 projects forming a new 3,631-mile 765 kV and 345 kV backbone transmission line in the U.S. Midwest, including interconnections to Pennsylvania New Jersey-Maryland Interconnection’s (PJM) existing 765-kV system.

• Timeline: The bulk of the construction is expected to begin after 2029, with projects targeted to go into service between 2032 and 2034.

• Addressing Critical Challenges: Tranche 2.1 addresses pressing challenges, such as the interconnection backlog caused by the surge in renewable generation projects and higher energy demands from new developments such as data centers.

• Economic and Reliability Benefits: MISO projects that Tranche 2.1 will generate net benefits ranging from $23 billion to $72 billion over 20 years, driven by factors such as avoided capacity costs, enhanced reliability, and progress toward decarbonization goals.

Morningstar DBRS’ Credit Perspective

MISO’s Tranche 2.1 represents a significant step toward enhancing grid reliability and efficiency in the Midwest subregion. We believe FERC, which oversees MISO and the approval of new transmission projects, provides a credit-supportive regulatory framework that is crucial for sustaining utility investments. We note that a utility’s credit metrics may face temporary pressure during capital-intensive construction phases. Given that the length of transmission projects is typically less than three years, we generally take a longer-term, rating-through-the-cycle perspective when assessing potential credit impact. Our primary concern remains focused on potential long delays and cost overruns, which could lead to a reevaluation of the project and potential restrictions on cost recovery. Overall, we expect the credit impact to be neutral, provided that utility companies can finance the capex and maintain their debt-to-capital ratios in alignment with the regulatory capital structure.

MISO’s Alignment With FERC Order No. 1920 Should Benefit Transmission Owners

On May 13, 2024, FERC issued its landmark long-term transmission planning rule, Order No. 1920. The order mandates transmission providers to engage in proactive, forward-looking transmission planning to address an evolving generation mix and reliability challenges over a 20-year horizon. Several factors should reduce the likelihood of FERC disallowances, including MISO’s approach, which incorporates comprehensive scenario-based planning; a cost allocation methodology consistent with FERC’s cost causation principle; and strong stakeholder engagement. We believe that transmission owners stand to benefit from this alignment, with MISO directly overseeing project awards.

Legal Challenges to Right of First Refusal (ROFR) Laws Could Create Delays

ROFR laws, which grant incumbent utilities the preferential right to develop MISO-approved transmission projects, have been criticized for being anti-competitive and limiting the participation of independent developers. Currently, eight of MISO’s 15 member states have enacted ROFR laws or similar provisions, with these laws under legal scrutiny in states such as Iowa and Indiana. Nearly 70% of the Tranche 2.1 portfolio is proposed on new transmission corridors, in contrast to Tranche 1, where approximately 80% of the line miles were proposed on incumbent transmission owners’ rights-of-way. As a result, we anticipate more competitive solicitations and potential legal challenges as stakeholders vie for market access.

Uncertainty on Decarbonization Policies Could Weaken Cost-Benefits

The development of the 765 kV transmission is crucial for accommodating intermittent generation such as wind and solar. However, uncertainty regarding the incoming Trump administration’s stance on clean energy programs and federal policies like the Inflation Reduction Act and renewable energy incentives could slow the growth of renewable projects. Additionally, some MISO member states are reevaluating their decarbonization goals, prioritizing cost-effectiveness and reliability over aggressive renewable buildouts. These changes may reduce the immediate demand for large-scale transmission infrastructure projects, complicating cost-benefits analysis and cost-allocation methodology.

Note: All figures are in U.S. dollars unless otherwise noted.

About Morningstar DBRS

Morningstar DBRS is a full-service global credit ratings business with approximately 700 employees around the world. We’re a market leader in Canada, and in multiple asset classes across the U.S. and Europe.

We rate more than 4,000 issuers and nearly 60,000 securities worldwide, providing independent credit ratings for financial institutions, corporate and sovereign entities, and structured finance products and instruments. Market innovators choose to work with us because of our agility, transparency, and tech-forward approach.

Morningstar DBRS is empowering investor success as the go-to source for independent credit ratings. And we are bringing transparency, responsiveness, and leading-edge technology to the industry. That’s why Morningstar DBRS is the next generation of credit ratings.

Learn more at dbrs.morningstar.com.